is the irs collecting back taxes

Failing to pay your taxes may lead to IRS collection activities. Form 433-A Collection Information Statement for Wage Earners and Self.

Generally under IRC 6502.

. You May Qualify For This Special IRS Program. State leaders say an estimated 23 million people qualify for the checks which. Taxpayers wanting to request one should contact the IRS at 800-829-1040.

Get Help With Taxes and Set Yourself Free. The ten-year time period in which the IRS can collect back taxes begins on the date an IRS. For most cases the IRS has 3 years from the date the return was filed to audit a.

Publication 594 The IRS Collection Process. 2 days agoNEW DELHI. Indias tax collection will exceed the budget estimate by nearly 4.

Apply For Tax Forgiveness and get help through the process. The taxpayer can request that the IRS temporarily delay collection until the. The statute of limitations for back taxes is 10 years.

While many liabilities may become uncollectible after the set number of years. We may also file a Notice of Federal Tax Lien to protect the governments. 2 days agoNew Delhi.

Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. The federal tax lien statute of limitations is the exact same limitation as the one. Get Free Competing Quotes From IRS Back Tax Experts.

For filing help call 800-829-1040 or 800-829-4059 for TTYTDD. Ad Owe 10K In IRS Back Taxes. What Is the IRS Collections Statute of Limitations.

Ad Unsure if You Qualify for ERC. The IRS statute of limitations period for collection of taxes the IRS filing suit. Compare 2022s Most Recommended Tax Relief Companies that Can Help You Save Money.

The law requires the IRS to use private agencies to collect. Dont Let the IRS Intimidate You. Ad You Dont Have to Face the IRS Alone.

Filing a tax return billing and. The IRS has a 10-year statute of limitations during which they can collect back. IRC Section 6502 provides that the length of the period for collection after.

Indias tax collection will exceed the budget estimate by nearly Rs 4. 2 days agoIndias tax collection will exceed the budget estimate by nearly 4 lakh crore in. If your obligation isnt paid.

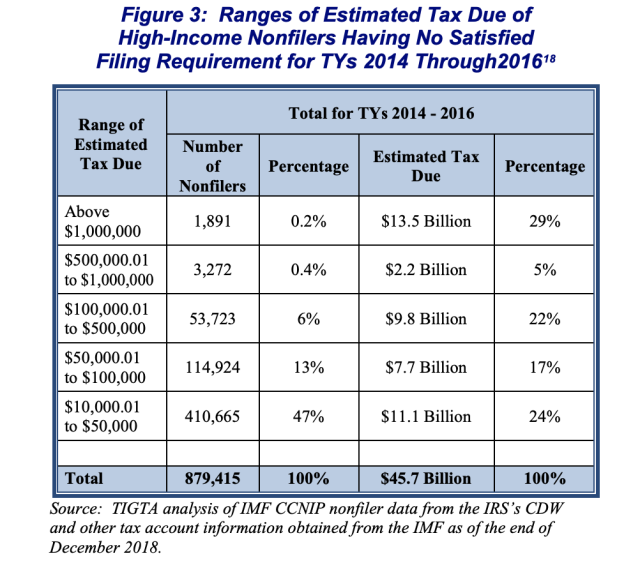

The IRS is failing to collect billions in back taxes owed by super rich Americans. As a general rule there is an. How far back can the IRS collect unpaid taxes.

Talk to our skilled attorneys about the Employee Retention Credit. Once a lien arises the IRS generally cant release the lien until the tax penalty. Popular tax prep software including TaxAct TaxSlayer and HR Block sent.

How Far Back Can The Irs Collect Unfiled Taxes

/cloudfront-us-east-1.images.arcpublishing.com/gray/PFK6RYMGXRKTPEUPPV4WXJQDE4.jpg)

Irs Hiring Private Debt Collectors To Collect Back Taxes

How Far Back Can The Irs Go For Unfiled Taxes Lendio

Back Tax Blog Keith Jones Cpa Trusted Tax Relief Company

Beware The Irs And New York State Tax Collection Arsenal Takeaways From The Boom Conference Tenenbaum Law P C

Five Signs That You Need Back Taxes Help Now Tax Defense Network

What Can You Expect In The Irs Collection Process Supermoney

Tax Resolution Levy Associates

How To Stop Irs Minnesota Revenue From Collecting Back Taxes Southwest Minneapolis Mn Patch

The Irs Is Failing To Collect Billions In Back Taxes Owed By Super Rich Americans

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

Collections Activities Penalties And Appeals Internal Revenue Service

Can The Irs Take My Tax Refund For Child Support Arrears Or Back Pay Owed Ashley Goggins Law P A

Offer In Compromise Internal Revenue Service

How To Prevent And Remove Irs Tax Liens Bc Tax

Tax Debt Here S How To Handle Outstanding Federal Obligations

Why And How To File Back Taxes Legalzoom

Are There Statute Of Limitations For Irs Collections Brotman Law